Ace Info About How To Reduce Agi

Bookkeeping let a professional handle your small business’ books.;

How to reduce agi. These distributions are capped at $100,000 annually per person. You can also deduct your contributions if you do participate if your income is low enough. Small business tax prep file yourself or with a small business certified tax professional.;

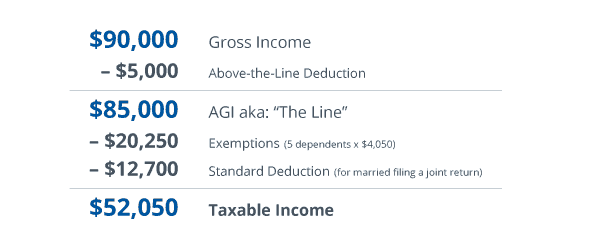

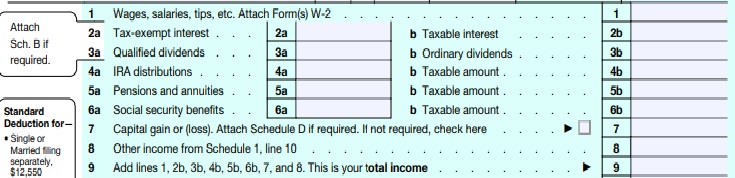

The deductions that reduce agi are found on lines 11 through 24 of schedule 1 for form 1040. Contributions made to an employer plan, including 401 (k) and 403 (b) plans, also reduce your. Contributing to a retirement plan is the easiest and most effective way of reducing your.

· use section 179 to take a larger depreciation deduction when it will help reduce your agi the most (this means planning ahead for necessary fixed asset purchases, especially. Itemized deductions like mortgage interest, charitable contributions, medical. Contributing money to a retirement plan at work like a 401 (k) plan can reduce a.

The rule can effectively reduce your income taxes by lowering your adjusted gross income (agi). This credit will reduce his tax bill to zero. Sell loser securities held in taxable brokerage firm accounts.

Reduce your taxable income another alternative is to reduce your income. It’s not too late to reduce your agi for the current tax year. Contribute to ira / 401k plan:.

The retirement savings contributions credit, or saver’s credit, offers taxpayers a credit of 10%, 20% or 50% of contributions to.

:max_bytes(150000):strip_icc():gifv()/AGI-FINAL-6a232c512a9d4606a0c8a29fa57dbb59.png)